NdFeB Permanent magnets

Neodymium, iron and boron make up the strongest commercial magnets known to humankind, and they are the principal driver of the rare earth industry. Recently, demand for NdFeB permanent magnets has increased due to playing a key part in environmentally friendly technologies such as electric vehicles and wind power.

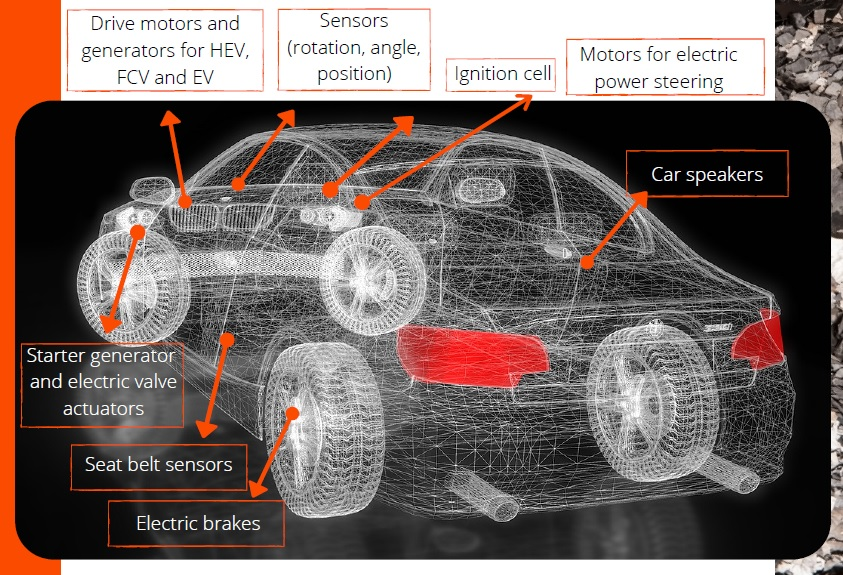

Each electric vehicle contains around 2kg – 2.5kg of NdFeB magnets which means the pressure is going to rise as Governments push for a “greener” way of life. These strong magnets are found in car speakers, electric brakes, starter generators, drive motors, sensors and ignition cells.

The main rare earth elements used in powerful permanent magnets are neodymium (Nd), neodymium praseodymium (NdPr), dysprosium (Dy) and terbium (Tb). Nd and NdPr are light rare earth elements and relatively abundant elements. Dy and Tb are heavy rare earth elements, they are scarce and expensive elements giving a substantial overall price tag to the magnets.

A Chinese dominant industry

More than 90% of rare earth magnets sold globally are made in China. Such a high percentage reflects good quality, excellent customer service and extraordinary low prices which makes it extremely difficult to market entry for non-Chinese competitors. The Chinese markets also have a fully integrated infrastructure which includes recycling.

There have been big investments in research and development over many decades including rare earth enterprise zones, financial support, low-cost rental and tax breaks. In addition, the Made in China 2025 policy shows a clear objective to shift focus further downstream from the global supply of magnets to components and customer goods.

This dominance over any market is a concern because of strategic vulnerability. Overdependence on a single source is risky business and there is a possibility of supply disruption.

The presence of a NdFeB magnet industry outside of China

The situation and players in the fast-paced NdFeB industry are constantly changing. Good quality magnet makers exist outside China, but the high cost of raw materials means they operate mainly in niche markets rather than the mainstream.

Some non-Chinese raw material production has been established, focussed mainly on the light rare earths; cerium (Ce), lanthanum (La), praseodymium (Pr) and neodymium (Nd). However, there are issues surrounding the high costs of non-Chinese magnets.

A viable non-Chinese supply chain offers key advantages in terms of transparency, diversification of supply sources and scope for ensuring the highest possible levels of Environmental Social and Corporate Governance.

Global magnet buyers have stated they need alternatives but historically have been reluctant to pay premiums over Chinese prices.

Any supply chain needs to be competitive, and this can only be achieved by ensuring each step in the chain is as low-cost as possible and by establishing close collaboration between all participants.